इस पोस्ट में आप सीखेंगे की कैंडलस्टिक चार्ट पर कैसे बनती है और इन्हें कौन बनाता है, आप शेयर मार्केट में कैंडलस्टिक को कैसे ट्रेड करके प्रॉफिट कमा सकते हैं इसकी पूरी प्रक्रिया step by step बिल्कुल सिंपल भाषा में बताई है👍

Candlestick Chart Par Kaise Banti Hai Aur Kaun Banata Hai? 📈🔥

1. Candlestick Chart Kya Hota Hai? 🕯️📊

Candlestick chart ek aisa visual representation hota hai jisme kisi stock ya index (jaise Nifty ya Bank Nifty) ka price movement dikhaya jata hai.

Har candlestick 4 important price levels ko represent karti hai – open, high, low, aur close.

Jab bhi kisi stock ka price market mein fluctuate karta hai, tab ye levels bante hain.

Candlestick chart ko technical analysis ke liye traders kaafi use karte hain kyunki isme price action ko aasani se samjha ja sakta hai. ✅📈

2. Candlestick Kaise Banti Hai? 🏗️📉

Candlestick tab banti hai jab koi stock ya index kisi particular time period ke dauran trade karta hai.

Har candlestick ek specific time duration ko represent karti hai – jaise 1 minute, 5 minute, 1 din, ya 1 week.

Is time frame ke andar, stock ka pehla trade (opening price) candlestick ka lower ya upper body ka hisa banta hai, aur last trade (closing price) body ka doosra hisa hota hai.

Agar stock ki price high jaati hai toh ek green (bullish) candle banti hai aur agar price low jaati hai toh red (bearish) candle banti hai. 🟢🔴

Example:

Agar Nifty ka price ek din mein ₹18,000 se shuru ho kar ₹18,200 par close hota hai aur beech mein ₹18,250 tak pahuchta hai, toh ek green candle banegi jisme ₹18,000 open hoga, ₹18,200 close, aur ₹18,250 highest point dikhaya jayega. 📉📊

3. Candlestick Kaun Banata Hai? 🧑💻🔍

Technically, candlestick chart ko koi manually nahi banata.

Yetrading platforms aur software automatically banate hain jaha market ke price data ko visual form mein dikhaya jata hai.

Har trade ka data, jaise open price, high price, low price, aur close price, stock exchange se live aata hai aur chart par candlestick ki form mein represent hota hai. 🤖📊

Stock exchanges jaise NSE (National Stock Exchange) ya BSE (Bombay Stock Exchange) se price feed milti hai aur trading platforms, jaise Zerodha, Upstox, Angel One, ya TradingView, ise charts mein convert karte hain. ✅👨💻

4. Candlestick Ki Structure Kaise Samjhein? 🔍🧱

Candlestick chart ki structure kaafi simple hoti hai. Har candle ka ek body aur do shadow ya wick hote hain.

Body: Ye candle ke beech ka part hota hai jo open aur close price ke beech ka difference dikhata hai. Agar close price open se zyada ho, toh body green hoti hai (bullish). Agar close price kam ho, toh body red hoti hai (bearish). 🟩🟥

Wick/Shadow: Wick candles ke upar aur neeche ka patla hissa hota hai jo high aur low prices ko represent karta hai. Wick se pata chalta hai ki stock ne us period mein kitne high ya low point tak touch kiya. 📈📉

Example:

AgarBank Nifty ka price ek din ke andar ₹43,000 open ho, beech mein ₹43,500 tak jaye aur ₹42,800 tak gir jaaye, lekin finally ₹43,200 par close ho, toh candle ka structure kuch aisa hoga:

- Body: ₹43,000 (open) se ₹43,200 (close) tak.

- Upper Wick: ₹43,200 se ₹43,500 tak.

- Lower Wick: ₹43,000 se ₹42,800 tak. 🔺🔻

5. Candlestick Chart Ko Kaise Padhein? 📚🔎

Candlestick chart ko samajhne ke liye traders har candle ki body aur wick ka analysis karte hain.

Candlestick patterns ka use kiya jata hai taaki market ke aage ke moves ka andaaza lagaya ja sake.

Kuch popular patterns jaise Doji, Hammer, Engulfing kaafi popular hain trading mein. 📊🕯️

- Bullish Patterns: Jab green candles lagatar banti hain, toh ye signal hota hai ki market mein tezi aa sakti hai. 🟢🔥

- Bearish Patterns: Jab red candles banti hain, toh ye signal hota hai ki market mein girawat aane ka chance hai. 🔴📉

Example: Agar chart par ek hammer pattern banta hai, toh ye signal hota hai ki market mein niche se buying pressure aa raha hai aur price upar ja sakti hai. 📈💡

6. Candlestick Chart Ka Analysis Kyon Important Hai? 📈💼

Candlestick chart ka analysis karne se traders ko short-term aur long-term market trends ko pehchaanne mein madad milti hai.

Isse aap market ke mood ko samajh sakte hain aur apne trades ko accordingly adjust kar sakte hain. 🧑💻✅

Candlestick patterns ka analysis aapko better decision making mein help karta hai.

Jaise agar aap dekhte hain ki lagatar bullish candles ban rahi hain, toh aap buy karne ka plan bana sakte hain.

Agar bearish candles ban rahi hain, toh sell ya short-selling ka option dekh sakte hain. 📉📊

Candlestick Ko Trade Kaise Kare – Ek Practical Step by Step Guide 📊🕯️

Candlestick chart trading beginners ke liye thoda mushkil lag sakta hai, lekin agar aap isse systematically samjhe toh aap isse profitably use kar sakte hain.

Ab hum step-by-step samjhenge ki candlestick patterns ko kaise trade karein, kis tarike se inhe interpret karein, aur kaise real examples ke saath inhe implement karein. 🧑💻✅

1. Candlestick Chart Ko Samajhna Aur Set Karna 🕯️📈

Candlestick chart ko trade karne ke liye sabse pehle aapko apne trading platform par candlestick chart setup karna hoga.

Aaj kal ke most platforms, jaise TradingView, Zerodha, ya Upstox mein candlestick chart ka option easily mil jata hai.

STEPS:

- Open Your Trading Platform – Apne platform par jaakar stock ya index ka chart open karein (jaise Nifty, Bank Nifty, Reliance, etc.).

- Select Timeframe – Timeframe select karein, jaise 1 minute, 5 minute, daily, ya weekly chart. Beginners ke liye, 5 minute aur daily chart zyada suitable hote hain. 🕒✅

- Switch to Candlestick – Chart style mein jaakar “Candlestick” select karein. Isse aapko stocks ka price movement clear dikhne lagega. 📊🔍

2. Popular Candlestick Patterns Ka Gyan Lena 📚🔍

Candlestick ko trade karne ke liye, aapko popular candlestick patterns ke baare mein gyaan hona chahiye.

In patterns se market ke short-term aur long-term trends ka idea lagaya ja sakta hai. Kuch important candlestick patterns jo aapko trade karne mein madad karenge:

1. Bullish Engulfing Pattern:

Jab ek chhoti red candle ke baad ek badi green candle usse completely engulf kar leti hai. Ye signal hota hai ki price upar ja sakta hai. 🟢📈

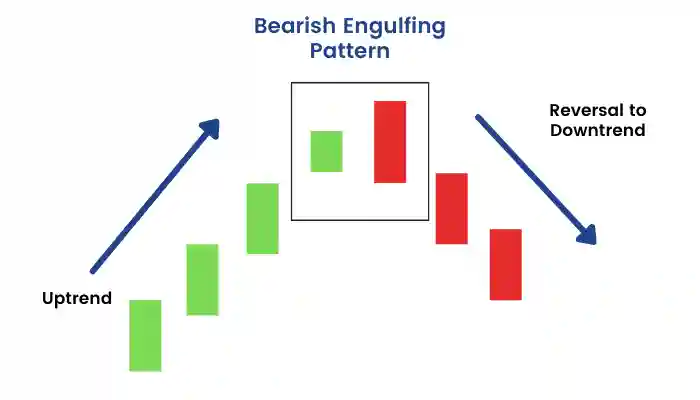

2. Bearish Engulfing Pattern:

Jab ek chhoti green candle ke baad ek badi red candle usse engulf kar leti hai. Ye signal hai ki price neeche gir sakta hai. 🔴📉

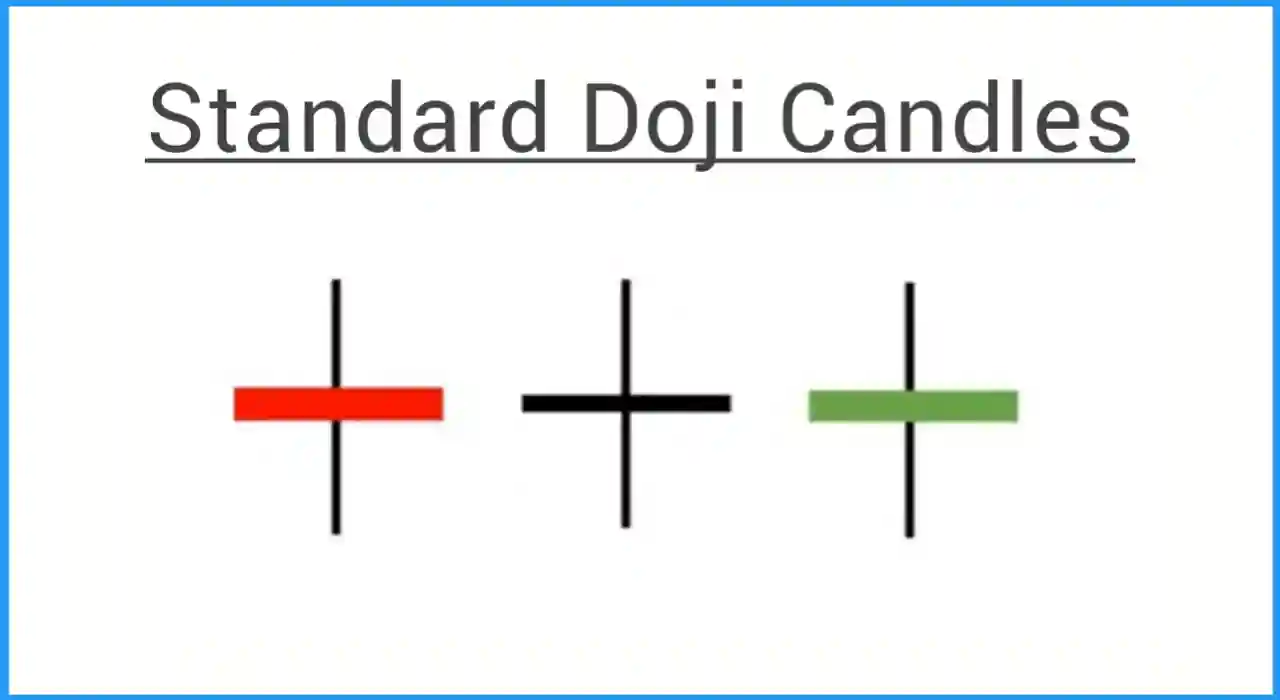

3. Doji Pattern:

Jab opening aur closing price almost same ho, toh Doji pattern banta hai. Ye indecision ka signal hota hai aur price reversal ya breakout ka sign deta hai. ❓🔄

3. Trend Pehchanna 📉🔍

Candlestick ko trade karte waqt sabse important hai trend ko pehchanana. Market ya stock ka trend 3 type ka hota hai – Uptrend (tezi), Downtrend (girawat), aur Sideways (range-bound).

- Uptrend: Jab market lagatar higher highs aur higher lows banata hai. 🟢📈

- Downtrend: Jab market lower highs aur lower lows banata hai. 🔴📉

- Sideways: Jab market ek range mein move karta hai, bina kisi clear direction ke. ↔️📊

Example: Agar aap dekhte hain ki Bank Nifty ka chart lagatar upar ke side higher highs bana raha hai, toh ye ek uptrend ka signal hai, aur aap bullish trades karne ki soch sakte hain. ✅📈

4. Support Aur Resistance Dhundhna 🔍🧱

Candlestick chart par support aur resistance levels ko dhundhna kaafi important hota hai.

- Support wo level hota hai jaha price neeche gir kar rukta hai aur upar jaane lagta hai,

- jabki resistance wo level hota hai jaha price upar jaakar rukta hai aur neeche girne lagta hai.

STEPS:

- Support: Identify karein wo area jaha price baar-baar neeche aakar reversal le raha hai. ✅📉

- Resistance: Dekhein wo level jaha price baar-baar upar jaakar gir raha hai. 🚫📈

Example: Agar Reliance ka stock ₹2500 par baar-baar support le raha hai aur waha se upar jaa raha hai, toh aap ₹2500 ke aas-paas buy karne ka plan kar sakte hain.

5. Entry Aur Exit Points Identify Karna 🎯🔄

Candlestick patterns ko dekhte hue aapko perfect entry aur exit points dhundhna hoga. Iske liye aapko pehle patterns ke signals ko confirm karna hoga.

- Entry Point: Jab candlestick pattern aapko ek clear signal de ki price upar ya neeche ja sakta hai, toh aap entry le sakte hain. 🏁

- Exit Point: Aapko predefined exit point set karna chahiye – ya toh profit book karne ke liye, ya phir loss se bachne ke liye. 🏳️

EXAMPLE:

- Bullish Entry: Agar aap dekhte hain ki Reliance ke chart par bullish engulfing pattern bana hai, toh aap stock ko buy kar sakte hain jab next candle green ho.

- Bearish Entry: Agar Nifty ka chart bearish engulfing pattern dikha raha hai, toh aap sell ya short position le sakte hain. 📉🚀

6. Risk Management Ka Palan Karna ⚖️🔒

Candlestick trading mein risk management sabse zaroori hissa hai.

Aapko hamesha apne trade ka risk reward ratio maintain karna chahiye.

Aap kabhi bhi apne portfolio ka zyada hissa ek trade mein invest na karein.

Stop Loss Set Karna:

- Har trade mein ek stop loss zarur set karein taaki agar market aapke against jaye, toh aap zyada loss na karein.

- Stop loss wo predefined price level hota hai jaha aap apna loss cut kar lete hain. 🛑⚖️

Example: Agar aap ₹1000 par koi stock buy karte hain aur aapka analysis kehta hai ki price ₹1200 tak ja sakta hai, toh aap ₹950 ka stop loss set kar sakte hain taaki aap ₹50 se zyada ka loss na karein.

7. Real Example – Reliance Stock ka Candlestick Trade 🏗️🔍

Chaliye ek real example se candlestick trading samajhte hain.

EXAMPLE:

- Reliance ka stock ₹2400 se start hota hai aur next 3 din tak upar jaakar ₹2500 tak pahuchta hai.

- Us din chart par aap dekhte hain ki ek Doji pattern ban raha hai.

- Ye pattern signal deta hai ki market indecisive hai aur price reversal ho sakta hai.

STEP 1: Aap confirm karte hain ki Doji pattern ke baad ek red candle banti hai. Ye bearish signal hota hai.

STEP 2: Aap ₹2480 par stock short karte hain (sell karte hain), expecting price to fall.

STEP 3: Aap ₹2500 ka stop loss set karte hain aur target price ₹2400 lagate hain.

STEP 4: Next din price ₹2420 tak girta hai aur aap apna profit book kar lete hain. ✅📉

कैंडलस्टिक पेटर्न के बारे में सबसे आसान भाषा में और उदाहरण के साथ सीखने के लिए आपको नीचे दी गई किताब जरूर पढ़नी चाहिए जो अब तक की कैंडलस्टिक पर लिखी गई सबसे बेस्ट किताब है. नीचे दिए इमेज पर क्लिक करके आप इस किताब को डाउनलोड कर सकते हैं―

CONCLUSION 🎯📝

Candlestick trading ek art hai jisme practice aur patience dono ki zarurat hoti hai. Candlestick patterns ka analysis aapko better trades lene mein madad karta hai, lekin aapko hamesha risk management ka dhyaan rakhna chahiye.

Agar aap support-resistance, patterns aur stop loss ko dhang se samajh lete hain, toh candlestick charts se aap consistent profits bana sakte hain. 📈💸

To aaj hi aap apne trading platform par candlestick charts ka analysis shuru karein aur smart trading decisions le! 🚀

ALSO READ:

- चार्ट पैटर्न क्या हैं और कितने प्रकार के होते हैं?

- कैंडलस्टिक क्या होती है– इसके सभी प्रकार समझें

- सभी 35 शक्तिशाली कैंडलस्टिक पेटर्न (उदाहरण सहित)

- कैंडलस्टिक पेटर्न सीखने के लिए बेस्ट किताब 👍

- (Top 10) बेस्ट बुलिश कैंडलस्टिक पेटर्न